The fragility of the financial system can have dire economic consequences is one of the key learnings from the Global Financial Crisis (2007-09). The impact of the crisis was exacerbated due to the interconnectedness of financial institutions and international financial markets. Monitoring the fragility of the financial system, referred to as systemic risk in financial literature, is crucial for regulatory responsiveness and financial stability.

Since the onset of the crisis, several measures are proposed to assess the level of systemic risk within the financial system, especially the banking sector. These measures rely on either market price data or a mix of financial statements and market price data. There are two problems with the application of existing measures. First, market price data is susceptible to noise, volatility, under- and over-reaction, investor sentiments, rumors, limits to arbitrage, herding, and illiquidity that may lead the market prices to differ from the fundamental values. The results may be miscalculation (under- or over-estimation) of systemic risk. Second, in countries where the capital markets are underdeveloped, or most banks/financial institutions are not listed, resultantly, the existing measures may be prone to sample selection bias and have limited applicability.

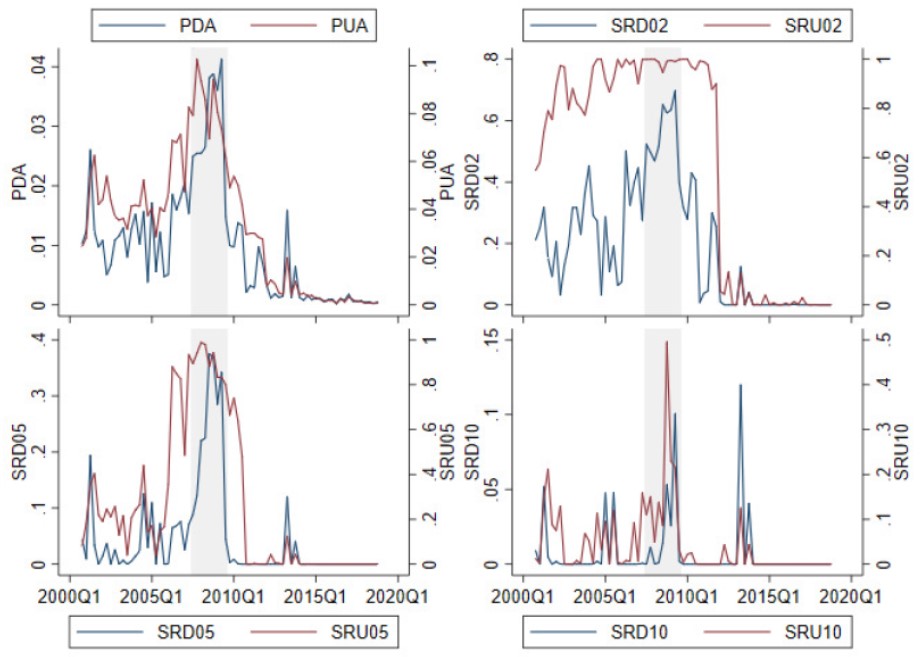

In a recent publication in the Journal of Forecasting, Ghufran Ahmad, Muhammad Suhail Rizwan, and Dawood Ashraf propose new systemic risk measures, using financial statement data and copula‐based estimation method. Authors use the Gaussian copula to generate simulated values of equity for the banks using the current and long-term assets and liabilities from the financial statements. For estimating systemic risk, authors use defaulted banks with negative simulated equity, or under-capitalized banks for which simulated equity is less than 3 percent of their assets, which is the significantly under-capitalized level of equity under the Prompt Corrective Action of the Federal Deposit Insurance Corporation. The proposed measures are then defined as the probability of assets held by the defaulted banks exceeding 2, 5, and 10 percent of the total assets and are referred to as SRD02, SRD05, SRD10, respectively. Authors similarly define SRU02, SRU05, and SRU10 for the under-capitalized banks. Aside from these measures, authors also define two additional measures: the proportion of defaulted assets (PDA) and the proportion of under-capitalized assets (PUA) that measure the proportion of the total assets which are held by the defaulted and under-capitalized banks, respectively. Since these proposed measures do not rely on market-price data, these are less susceptible to market noise and are globally applicable.

In the published paper, the proposed measures estimate the systemic risk in the U.S. financial system by using the data of bank holding companies from the first quarter of 2000 till the fourth quarter of 2018. The figure shows the evolution of the estimated values of systemic risk for eight of the proposed measures (SRD02, SRD05, SRD10, SRU02, SRU05, SRU10, PDA, and PUA). The figure shows that these measures show significantly elevated levels of systemic risk during and before the Global Financial Crisis (the gray shaded area), suggesting a leading trend of these measures.

The study also compares the performance of proposed measures with two of the best performing existing measures, namely, PQR and CATFIN, in addition to the St. Louis Fed Financial Stress Index, a comprehensive measure constructed from 18 different financial variables using principal component analysis. The comparison is based on the ability of the systemic risk measures to forecast the shocks to various macroeconomic indicators up to six quarters into the future. The forecasting evaluation indicates that the proposed measures outperform the historical unconditional quantile of macroeconomic indicators and perform competitively with the market-data-based measures of systemic risk.

Due to the global applicability and competitive results of the forecasting evaluation with some of the best performing systemic risk measures, the newly proposed measures will prove helpful for the national/global regulators and policymakers to assess and better regulate systemic risk.

Reference:

Ahmad, G., Rizwan, M. S., & Ashraf, D. (2021). Systemic Risk and Macroeconomic Forecasting: A Globally Applicable Copula‐based Approach. Journal of Forecasting. DOI: https://doi.org/10.1002/for.2774

List of Authors:

Dr. Ghufran Ahmad

Assistant Professor

International Business & Marketing

NUST Business School (NBS)

National University of Sciences and Technology (NUST), Pakistan.

[email protected]

Dr. Muhammad Suhail Rizwan

Assistant Professor

Finance & Investment

NUST Business School (NBS)

National University of Sciences and Technology (NUST), Pakistan.

[email protected]

Dr. Dawood Ashraf

Senior Research Economist

Islamic Research & Training Institute (IRTI)

Islamic Development Bank, Jeddah, Saudi Arabia.

[email protected]