Tax evasion is a common problem among many countries, and becomes a survival threat to developing economies such as Pakistan. Due to manual estimation methods, collection of property tax in Pakistan, specifically the tax on build-up properties in cities, is a significant challenge. This tax is estimated based on the height of the build-up properties, no. of floors, and spatial area of the building. Can we automate this tax estimation process using some sort of AI?

Imagery obtained from satellite or aerial sensors is an extremely rich source of information with a precise level of accuracy for the geolocation of a terrain. Such aerial images are already widely being used for the analysis of terrain and detection for artificial, or man-made, objects and planning and monitoring the urbanization of any area. Considering the fact that satellite imagery is a huge source of information, it can be used to perform some advanced tasks in order to aid modern digital solutions to contribute to the advancements in every field. Estimation of property tax is one of these applications where modern AI technology can be used to increase work efficiency and reduce cost.

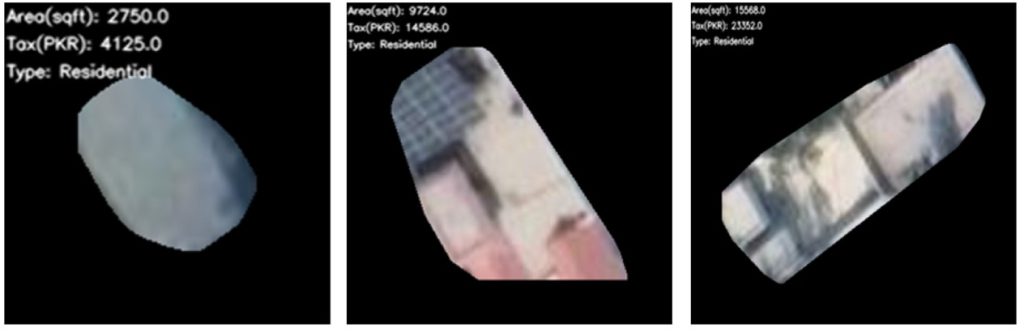

Digital Surface Models (DSMs) of the area of interest are required for building an AI model designed to estimate tax on a property from the satellite Imagery. DSMs provide not only the structures of a terrain but also give an idea of the depth of any point in the image. This is due to the fact that DSMs are gray scale images with pixel values that correspond to the depth of any point in the terrain. These DSMs can be used to build models for not only estimating the heights of buildings from aerial images, but also calculate the area a building occupies on a terrain. The height and the area combined give us an estimation of the tax imposed on the structure by any regulatory authority. This will not only save the department the manpower needed to conduct the same task manually, but also reduce the time taken to finish the whole process since computer models can perform the calculations much faster than humans.

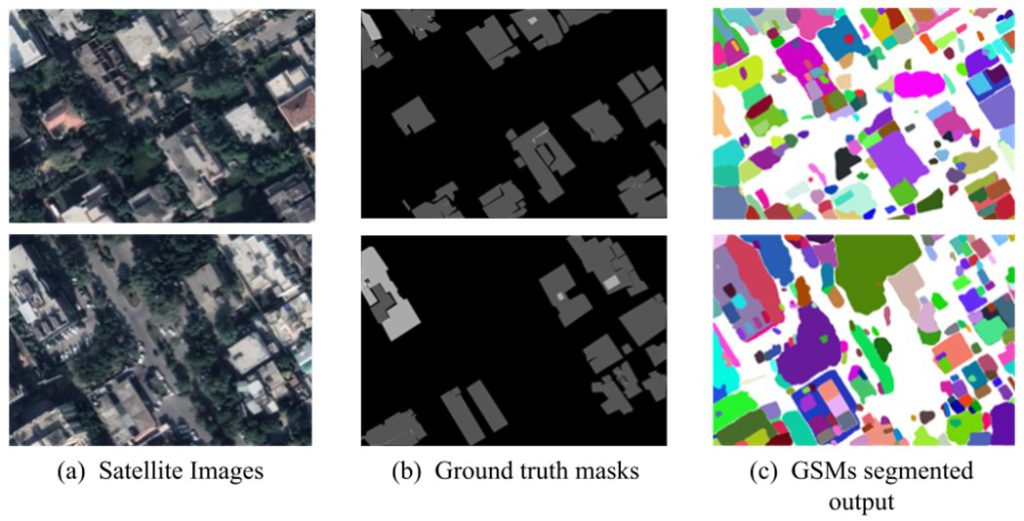

The use of DSM to estimate height of objects, however, demands the availability of DSMs. Unfortunately, Pakistan does not have a working mechanism, yet, to generate DSMs for R&D and the information regarding confidential data about the terrain of Pakistan cannot be probed. Therefore, if a method is developed to generate the DSMs from the satellite imagery, it will have wide ranging impact and applications far beyond tax estimation. It can be extremely useful to the Geological Survey of Pakistan (GSP), for example. To achieve such a goal, there are a number of proposed methods, for example image regeneration and/or semantic segmentation in order to classify the satellite image data into different regions of varying height. The regenerated DSM can then be used to estimate the height of a building.

We achieve the groundbreaking transformation in the realm of Digital Surface Models (DSMs) by crafting an all-encompassing pipeline that integrates a practical and real-world use case: the estimation of property tax for both residential and commercial buildings. While the current body of research has predominantly focused on DSM generation methods and explored theoretical applications, this project aims to distinguish itself by presenting a novel and innovative approach that incorporates a powerful tool for tax estimation within the DSM framework. At its core, this research revolves around harnessing cutting-edge DSM generation methodologies, building upon existing knowledge to attain a deeper understanding of the intricacies involved in data acquisition, manipulation, and model generation. However, it is the convergence of this expertise with a practical application that truly sets this project apart. The envisioned tool will serve as a potent resource, empowering authorities and decision-makers with an efficient, data-driven mechanism to accurately determine property tax values for any given locality.

The significance of this integrated approach cannot be overstated. By seamlessly blending DSM generation with tax estimation, this project aims to bridge a critical gap in the current research landscape, revolutionizing the way property taxation is approached and executed. Gone will be the days of relying on outdated and potentially error-prone traditional methods. Instead, the proposed tool will usher in a new era of efficiency, accuracy, and fairness in the taxation process, fostering equitable fiscal planning and resource allocation for both residential and commercial properties. Beyond its immediate domain, this project bears far-reaching implications. As an exemplary model for integrating cutting-edge research with practical applications, it serves as a blueprint for other domains seeking to address complex societal challenges.

By demonstrating the potential of such integrative approaches, this research encourages other scientists and innovators to explore similar avenues in their respective fields, culminating in transformative solutions that bridge the gap between theory and practice. The broader societal impact of this research cannot be underestimated. By equipping authorities with an accessible and powerful tax estimation tool, this project aims to stimulate a positive ripple effect, benefiting not only the governance and fiscal planning landscape but also the overall socio-economic development of communities. Accurate property tax estimations facilitate fair and sustainable resource allocation, ensuring that essential services and infrastructure are adequately funded and maintained.

The author is Assistant Professor at Department of Electrical Engineering, at School of Electrical Engineering and Computer Science (SEECS), NUST. He can be reached at latif.anjum@seecs.edu.pk.

Research Profile: https://bit.ly/3VRIss1

![]()